The Canada Greener Affordable Housing Program

The Canada Greener Affordable Housing Program

Canada’s Mortgage and Housing Corporation (CMHC) is modernizing all types of residential homes to be more energy-efficient, more affordable, and to extend the lifespan of these homes while reducing greenhouse gas emissions. The Canada Greener Affordable Homes (CGAH) funding program is designed to support the deep energy retrofits of existing multi-unit affordable housing. The energy consumption reductions, greenhouse gas emission reductions, how many of the National Housing Strategy priority population is being served, and number of houses will be used to determine where the fund is allocated.

The funds of the Canada Greener Affordable Housing program will be delivered and distributed through the Canada Greener Homes Initiative. This initiative consists of The Canada Greener Homes Grant (CGHG) and the Canada Greener Homes Loan (CHGL) for homeowners.

The Canada Greener Homes Initiative wants to help Canadian renters/homeowners lower their energy bills, reduce greenhouse emissions, and make their homes more comfortable. This fund will help affordable housing providers to improve aging buildings and to be more energy efficient. For long-term plans, these upgrades will help reduce operating costs, and they can continue to assist low-income households. Affordable housing residents will have improved indoor air quality and quality of life through upgrading retrofits, for example, the installation of heating and cooling systems, energy-efficient appliances, and windows and doors.

Eligible applicants include:

- Affordable housing providers (Social Housing Organizations, Non-Profit Housing Organizations, and Rental Co-Operatives)

- Municipal, Provincial, and Territorial Governments/Agencies and

- Indigenous Organizations (First Nation Bands, Tribal Councils, and Indigenous Housing Providers

Applicants must be an affordable provider with an affordable housing proposal and a mandate to prove housing is deemed affordable. For the housing project to be considered affordable, the mandate is to follow:

- Municipal, Provincial, Territorial, Indigenous Governments or CMHC program or product affordability criteria

- Other affordability criteria, for example, rent-geared-to-income, low-income, rent-limit/thresholds or other criteria CMHC accepts.

The Canada Mortgage and Housing Corporation is Canada’s authority on housing. In May 2023, the CMHC announced the Canada Greener Affordable Housing program will have $1.2 billion for low-interest repayable and forgivable loans over the next four years; this will allow affordable housing providers to complete energy retrofits for residential rental buildings.

The Pre-Retrofit funding program:

Greenhouse gas emissions, Canada’s aging infrastructure, and extreme weather due to climate-related impacts risk Canada’s health and safety. The Greener Affordable Housing (CGAH) program is committed to supporting climate change mitigation. (Climate change mitigation means avoiding and reducing heat-trapped greenhouse gas emissions into the atmosphere to help prevent global warming or Earth to rise in extreme temperatures) with these pre-retrofits and retrofit funding opportunities, we can start to reduce gas emissions and save energy with the new retrofits.

The Pre-Retrofit funding is for energy audits, energy modelling studies, and Building Condition Assessment reports.

The next Call of Window opens on November 1, 2023. (Now open until January 31st /23.)

The Retrofit Funding is for deep energy retrofits to reduce energy consumption and greenhouse gas emissions and rental buildings.

They are accepting applications until the fund has been all used.

The CMHC created the Canada Greener Affordable Housing program to build a climate-compatible future with activities, programs, and operations for Canada to reach its net-zero emissions goal by 2050.

*Always contact your CMHC Housing Solutions Specialist before preparing your application.

The Pre-retrofit Funding for multi-unit residential buildings:

The CMHC accepted Pre-Retrofit funding applications from June 1, 2023, to June 30, 2023, and is now open again until January 31, 2024. This year’s applicants must be ready to receive the funds by October 1, 2023, and have the work completed by March 31, 2024. If the Funds have not been depleted, the CMHC may consider re-opening the Application Portal on a first-come, first-serve basis until the funds have been utilized.

Fund details:

The application is through a Call-Out application-based process. $19.5 million is available for the Pre-Retrofit funding opportunity. The maximum amount per project is $130,000.00, and the funding will be available for three years starting 2023-2024.

Eligibility:

Eligible housing providers must have an affordable housing proposal and a proven mandate to provide housing to low-income or populations in need. This fund is open to:

- Community Housing Providers, Non-Profit Housing Organizations, Public Housing Agencies and Rental Co-operatives.

- Indigenous Governments, First Nations, Tribal Councils, and Indigenous Housing Providers

Eligible property types:

- Mixed-income rental, mix-use with affordable rental housing

- Community housing

- Affordable rental housing

- Indigenous community housing or cultural spaces

- Shelters, transitional and supportive housing

- Single-room occupancy

*non-residential component of the property is not to exceed 30% of total gross floor space.

Eligible housing types need to ensure that projects must:

- Be primarily residential.

- Include at least five units or beds.

- Be of a minimum age:

- - single detached, duplex, and townhouse must be at least ten years old.

- - mid-to-high rise, low-rise and multi-plex buildings must be at least twenty years old.

Eligible activities include:

- A Building Condition Assessment (BCA) report

- An Energy Audit (ASHREA3 or equivalent)

- An Energy Modelling study

- Project drawings and specifications

- Engineering studies

- Construction cost estimates.

- Demonstrate the benefits or impact of retrofit.

- Environmental Site Assessments or Hazardous Materials Report

- Site surveys

When you submit your application, you must provide a quote for each eligible pre-retrofit activity you are interested in. The quotes must include the estimated start and finish date. Applicants are to submit invoices for qualified expenses in the same fiscal year that they get approved.

*For a successful deep energy retrofit plan, you must complete a Building Condition Assessment, an energy audit, and an energy modelling study. Meeting these three requirements will tell you if you are eligible for the Retrofit Funding.

Application:

- Contact your CMHC Housing Solutions Specialist

- Make sure you have all your required documentation and submit your Integrity Declaration.

- After you’ve received confirmation from your CMHC Housing Specialist, submit your application to the Application Portal.

*Applicants are expected to submit invoices from eligible expenses in the same fiscal year of their approval.

Application Process:

- After the Application Portal closes, the CMHC will review eligibility and prioritize as needed in 30 days.

- Within 30 days, if you have completed your application, CMHC’s conditional approval will give you a contribution for your project.

- Provide all documents required ten days before each draw-down date. To request an advance, you’ll need the ‘contribution agreement,’ which outlines the process and any supporting documents.

To ensure you have everything you need for the program, double-check the:

- The Program Highlight Sheet (PDF)

- Required Documentation Checklist (PDF)

- Integrity Declaration (PDF)

- Applicant Guide (PDF)

All these documents are in PDF format and will show you everything you need to complete the application for the program.

The Retrofit Funding for Multi-unit Residential Buildings:

The Retrofit Funding program provides low-interest repayable and forgivable loans for deep energy retrofits for multi-unit residential buildings. Applications are being accepted until all available funding is used.

The Canada Greener Affordable Housing has a goal of net-zero emissions by 2050. The retrofit funding program opportunity is to help address the ‘climate capability’ and ‘resiliency’ (meaning to anticipate, prepare for, and respond to hazardous events, trends or disturbances related to climate, and to improve climate resilience. Climate resilience requires assessing how climate change will create new or alter current climate-related risks and how to cope better or prevent risks.)

The retrofit funding program requires completion of the pre-retrofit activities like energy audits, modelling study's, and a Building Condition Assessment (BCA) report to be submitted with the application.

Retrofitting work (for example, improving or changing light fixtures, ventilation systems, windows, and doors, and adding insulation. Keeping energy-efficient retrofits in all renovations or repair activities). If approved, the work must be done within two years of approval. However, the approved forgivable loan must be claimed in the same fiscal year as when approved. If your project was approved in the first application window (June 1, 2023, to July 31, 2023), you must claim the loan by March 31, 2024.

If funds are still available after the first application window, CMHC may consider re-opening the application portal for more project applications on a first-come, first-served basis until all the funds are used. The portal re-opened November 1, 2023, until January 31, 2024. The subsequent retro fund application call-out window will be open for 90 days.

Fund Details:

Through this call-out application-based process, up to $1.1 billion in forgivable and low-interest repayable loans are available.

- The CMHC will fund 100% of eligible retrofit costs of up to $170,000.00 per unit (repayable and forgivable loans combined); forgivable loans will be the lesser of

- $85,000.00 per unit or

- 80% of eligible retrofit costs

- The projected energy saving should help offset the repayable loan requirements.

- Funding will be available for over four years.

Fill out the Retrofit Funding Assessment Calculator (XSL) on the website and talk to your CMHC Housing Solutions Specialist about project eligibility.

Eligibility:

To be eligible, you must have a proven mandate to provide housing to lower-income households or populations in need. The funding is open to:

- Community housing providers, non-profit organizations, public housing agencies and rental co-operatives

- Indigenous governments, First Nations, Tribal Councils, and Indigenous housing providers

*Private market housing organizations are not eligible for this funding opportunity

Eligible Property Types:

- Mixed-income rental or mix-use with affordable rental housing

- Community housing

- Affordable rental housing

- Indigenous community housing and cultural spaces

- Shelters, transitional, and supportive housing.

- Single-room occupancy

*The non-residential component of the property is not to exceed 30% of the total gross floor space.

Eligible Housing Types Needed to Ensure that projects must:

- Be primarily residential.

- Include at least five units or beds.

- Be a minimum age:

- Single-detached, duplex and townhouses must be at least ten years old.

- Mid to high-rise, low-rise and multi-plex buildings must be at least 20 years old.

To qualify for the retrofit fund, your project will need to meet requirements for:

- Energy efficiency

- Financial viability

- Retrofit types.

Energy efficiency:

Deep energy retrofits must target the deep energy retrofits for the CGAH program must meet the requirements of:

- A 70% energy consumption relative to pre-retrofit performance

- An 80% reduction in Greenhouse gas (GHG) emissions relative to pre-retrofit performance.

Financial Viability:

Minimum debt coverage ratio requirements:

- A debt overage of 1.00 for the residential loan component

- A debt coverage ratio of 1.40 for the non-residential loan component

Security:

To qualify for retrofit funding, you need to provide security. We accept first, second, and pari pasu mortgages.

On-Reserve applicants: in addition to a ministerial loan guarantee, the CMHC will accept four other types of security. For more details, refer to the pre-application guide for more information.

Repayable Loans:

- The repayable loans are low-interest and pay back the loan up to the building’s lifespan (40 years maximum)

- The interest rate is locked in at first advance for a 10-year term. At the end of the period, you can renew the loan, and the rate will be reset and fixed for another ten years.

- The loan will be closed to prepayment during the 10-year term.

- Payments will be interest-only until the energy retrofits are completed. After the retrofits are completed, the principal and interest will be paid for the remainder of the loan term.

Forgivable Loans:

- Forgivable loans will be forgiven over ten years.

Pre-Application Documents:

- Gather the required documents to apply for this program on June 1, 2023. (Portal now closed, but if the fund is not fully committed to someone, a first-come, first-serve, as-needed basis will be applied)

- The documents you need need to provide the details of:

- How you plan to achieve the climate objectives with professional reports

- Detailed retrofit scope of work, including cost estimates for project and timeline completion.

- Review the Program Highlight Sheet (PDF)

Application:

- Talk with your Housing Solutions Specialist to help you gather the correct required documentation.

- Review the Required Documentation checklist (PDF) and submit the:

- Retrofit Funding Assessment Calculator (XSL)

- Integrity Declaration (PDF)

- Energy Assessment Attestation (PDF)

- After receiving confirmation from your CMHC Housing Solutions Specialist, submit your application in the application portal.

The Approval Process:

- The CMHC will review the application projects for eligibility and complete a financial analysis 60 days after the application window closes. To process the application, all required documentation must be submitted, and if there is a high demand for retrofit funding, the CMHC will prioritize based on:

- Achievement of environmental outcomes

- Project readiness (successful projects will be expected to start construction within six months.

- You’ll receive a loan agreement confirming the CMHC’s conditional approval of funding for your project if your application is complete, typically within 30 days.

- The first advance, the loan agreement, will outline the process and any supporting documentation needed to request an advance from the CMHC (the required documentation must be provided ten days before each draw-down date.)

Applications will be scored by:

- Project characteristics

- Depth of Energy consumption reductions

- Greenhouse gas emissions reductions

- Priority population served.

- And the number of units

All renovations on the retrofit upgrades must be completed within the set time frame, or your project may risk changes or cancellation of CMHC's funding commitment. If your project is approved, you must agree to Canada’s Greener Affordable Housing reporting requirements which are outlined in the funding agreement.

The Government of Canada aims to reach net-zero emissions (greenhouse gases) and increase climate resiliency (climate resilience means the capacity of social, economic, and ecosystems to cope with hazardous events, trends, or disturbances) by the year 2050. Applicants must meet the program's criteria. CMHC will fund 100% of the eligible retrofit costs for up to $170,000.00 per unit, and in the Pre-Retrofit program, the maximum contribution is $130,000.00.

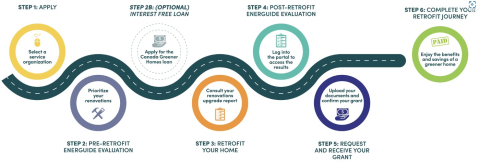

The Canada Greener Affordable Housing funding program was launched on May 26th, 2023. The pre-retrofit program provides grants for the pre-retrofit activities you will need to plan and prepare for these upgrades. If you need pre-retrofit upgrades, then this is the grant for you. The second program offers forgivable and low-interest loans to help finance the building retrofit measuring and other activities needed to meet the climate objective.

The CMHC received over 39,000 loan applications and the average eligible amount of these applications were given around $24,000.00 for the pre-retrofit or the retrofit funding opportunities. The top five retrofits across Canada are – windows and doors, heat pumps, air sealing, home insulation, and solar panels, as of August 31, 2023.

By: Tricia Cook, Content Navigator

External resources

- Get financing through the Canada Greener Affordable Housing program

- Pre-Retrofit Funding for multi-unit residential buildings

- Retrofit Funding for multi-unit residential buildings

- Climate Solutions » Resilience Solutions SHARE Climate Resilience Portal

- Canada Greener Homes Initiative Update - September 2023

- How the grant process works