New Construction Funding for On-reserve Housing

The Canada Mortgage and Housing Corporation (CMHC) is Canada’s number one authority on housing. The CMHC supports Canadian housing needs and ensures everyone has a place to call home, no matter where you find yourself on the housing continuum chart. These funding programs are for on-reserve new construction projects and other financing opportunities.

The CMHC plays an important part in Canada’s housing and finance systems. Through commercial programs, research & data, and funding programs, the CMHC contributes to Canada's housing system and housing needs. The CMHC provides funding for new construction on-reserve projects for indigenous housing.

1. Insured Loans for On-Reserve First Nation Housing

If you want to build, buy, or renovate a single-family, or a multi-unit rental in your community, then insured loans may be the way for you. The CMHC provides loan insurance to approved lenders. They can be a bank, credit union, or an Aboriginal Capital Corporation. Loans are secured through a council resolution and a ministerial loan guarantee from Indigenous Service Canada (ISC). To be eligible, you must follow the criteria. All information or requested documentation such as certification of possession or permission by the First Nation to use the land, may also need additional requirements depending on what type of property you’re going to build or purchase. If you cannot repay your loan, the approved lender will pay the balance, and the ISC will require payment from your First Nation. If you have any further questions or if you need more information, contact your First Nation Housing Specialist, or email them at mbinhs@cmhc-schl.gc.ca.

2. On-Reserve Non-Profit Housing Program (Section 95)

This funding program is for First Nations and all First Nation communities are eligible to apply, to build affordable rental housing, on-reserve. Eligible projects include new construction, purchase or rehabilitation of an existing house, or a conversion of a non-residential building into a livable housing unit. This program allows you to apply for low-cost repayable loans, housing subsidies, or borrowing from the CMHC or with approved lenders like a bank, trust companies or the Aboriginal Capital Corporation. The First Nation will manage the development of the project and the day-to-day operations. The Project Delivery Guide in PDF format will help you with your application, any documents you need, and the delivery process. This file will also help you in the pre-application process for the project completion. Some of the loans from the CMHC are insured under the National Housing Unit and may even cover up to 100% of the eligible costs for the project. You can also apply for the ‘Proposal Development Funding’ program (an interest-free, repayable loan) and four other types of security. Along with the Ministerial Loan Guarantee, the CMHC accepts four additional types of security for your housing projects:

- Pledge of land

- Leasehold interest

- Business revenue and personal property

- Letter of credit

These types of security can also be applied to other funding programs, such as the

Affordable Housing Fund, Apartment Construction Loan program, SEED, Section 95 and other requirements that the CMHC requires that your solicitor reviews and confirms that the application and securities meet all the requirements.

3. The Rapid Housing Initiative

The Rapid Housing Initiative was launched in 2020 to build permanent affordable housing for vulnerable people, people who are at risk of being or are homeless, and women and children fleeing domestic violence. 25% of the investments went towards ‘women-focused’ affordable housing projects. The funds they received went into two streams. The Cities Stream fund was allocated to 30 pre-determined cities which had 60 days to submit their project proposals through the online portal on the CMHC’s website. The Projects Stream received $1 billion to create or renovate existing houses. If your proposal was not fully funded, during the first round, those proposals were able to resubmit. Eligible projects received funding for one of three forms of housing:

- New Construction

- Modular (built off-site and then delivered and installed)

Conversions and Rehabilitations (conversion of a non-residential building into an affordable rental- building)

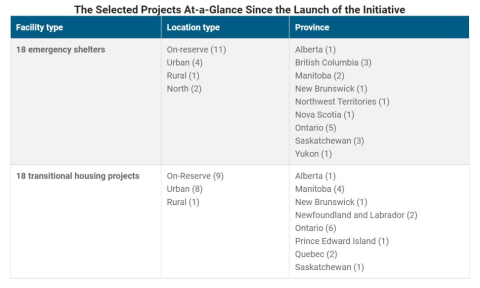

4. Indigenous Shelter and Transitional Housing Initiative

Beginning in 2021/22, the Canada Mortgage and Housing Corporation and Indigenous Service Canada have been taking steps towards Canada’s Federal Pathway to Address Violence Against Indigenous Women, Girls and 2SLGBTQQIA+ people by developing and funding. The CMHC has allocated $420 million over five years to construct new shelters and transitional homes and ISC will have invested in those shelters and transitional homes to support the operational costs and culturally relevant violence prevention activities. Any indigenous organization or level of Government of Canada is eligible to apply for this program. Through this initiative, 47 projects (24 shelters, and 23 transitional homes) have been providing shelters and transitional homes for indigenous women, children and 2SLGBTQQIA+ from gender-based or domestic violence. Projects are selected by an indigenous-led committee with representatives from:

- CMHC

- ISC

- Organizations representing First Nations, Metis, Indigenous 2SLGBTQQIA+ and urban committee

- subject matter experts

- people with experience with shelters or transitional homes

Shelters and Transitional housing proposals for Inuit-specific shelters and transitional homes are reviewed and chosen by an Inuit-led committee. The location of these proposed shelters and homes can be urban, rural areas and the North. When preparing to apply for this initiative, there are PDF format files that are available on the CMHC website that will help get all your documents, requirements, and budgets you may need.

Please review:

- the Application Guide (PDF)

- Mandatory Application Worksheet

- Evaluation Criteria

- Integrity Declaration Form

You can also request an offline PDF application and contact your Indigenous and the North Housing Solutions Specialist.

Applicants must provide a construction budget for your proposed facility.

If your project costs surpass the maximum cost of construction, you will need financial capacity or partners with equity to cover these costs.

Applicants must provide a yearly operational budget for their proposed facility.

Some of these units may have incorporated rent geared-to-income from their clients, which should be included in the operational- budget.

Each community has different needs, approaches, and weather. Applicants are advised to design their proposals or programs to meet the needs of their community.

5. Affordable Housing Innovation Fund

*This program accepts applications continually and may make funding announcements periodically.

*The CMHC may also use your information and ideas submitted for research and evaluation.

This funding program is for innovative housing providers to bring their knowledge and ideas to improve the housing industry. The CMHC has funding for your innovations that include affordability, innovation through a transformational approach, breakthrough approach, incremental approach, and financial sustainability.

The fund will provide $550.8 million over 6 million over 6 years beginning in 2022, until all the funds are committed. The proposals will be reviewed by experts in the housing industry, CMHC, and other expert reviewers from diverse backgrounds:

- Financial lending

- Academia

- Innovation

- Construction and Engineering

- all levels of Government

A knowledge transfer plan and information dissemination strategy for the project. A knowledge transfer includes sharing information, lessons learned, advancing capabilities in the housing sector, and informing policymakers, and builders, and seeding the next generation to improve housing affordability. Your project must also show, and support reducing energy and greenhouse gas emissions, increasing accessible units in the housing stock, and focusing on the needs of the population priority stated by the National Housing Strategy. If your proposal has demonstrated added value like replicability, and scalability, serving priority populations will allow your proposal to score higher. The proposals submitted will be prioritized through key elements:

- Innovation

- Affordability

- Financial sustainability

- Knowledge transfer

- Housing needs of priority populations

- Accessibility

- Partnerships promotion

- Scalability

- Replicability

- Reduction of energy usage and greenhouse gas emissions

- Development, implementation, and testing readiness.

With supporting documentation, you will also need to answer more questions:

- the timing of the residential and affordable unit implementation

- the amount of support sought from the residential and affordable for implementation

- climate/energy efficiency application.

- partnerships, status, form and type

- rent-to-own details for applications for the rent-to-own stream

- innovation readiness

- innovation details

- proponent experience

- innovation overview

- risks and mitigation

- innovation in housing affordability

- innovation sustainability

Download the ‘required documentation’ and information checklist to ensure that your project proposal has everything you need. If you miss any piece of information, your application cannot be assessed without all the required information and documentation. Always speak with your CMHC Housing Specialist and upload all your documents.

6. Seed Funding

The funding stream is closed for 2023 as that fund has all been allocated but will re-open again in 2024 with more funding opportunities for your community housing projects. This fund has two funding streams. One is for new construction and conversions and the other is to preserve existing community housing projects. The Seed Fund is to provide contributions or loans to help with the cost of building brand-new homes or renovating existing housing units.

The maximum interest-free loan can be up to $350,000.00 (security may be required) for three years and can be used with non-repayable contributions of up to $150,000.00 (and this non-repayable contribution must be invoiced by December 31 of that year of approval), to build new housing units and renovations to preserve existing community housing.

The eligibility of the program includes:

- Private or public housing providers, and non-profit housing organizations serving indigenous or northern populations.

- Municipal, provincial, or territorial governments, including their agencies serving Indigenous or northern populations.

- Indigenous governments and organizations, including bands and tribal councils.

- Private entrepreneurs/builders and developers

On the CMHC website, the SEED funding webpage has PDF format files:

- Product Highlight Sheet

- Seed Funding Application – required documentation listing

- Development checklist for Affordable Housing

- Rental Market Data

- CMHC Viability Assessment

- Integrity Declaration

Advances will be available once invoices are received with documentation showing all activities are completed, before being approved. Any expenses or costs related to the eligible activities completed before the project proposal is approved will not be considered. Always contact your CMHC Housing Solutions Specialist to ensure you have all the required documentation you’ll need for your application.

7. Preservation Funding for Community Housing

*CMHC is accepting and reviewing applications continuously

This funding program is for community housing providers to complete preservation activities to sustain existing community housing projects. For existing community housing providers, non-profit housing organizations and rental cooperatives to be eligible for this program you must meet the eligibility requirements:

- You’re under an active, eligible federally administered operating agreement.

- Previously were subject to a federally administered operating agreement that is expired, including agreements that were transferred to SHA that are expired.

- If you’ve been previously approved for the Preservation Fund and activities were completed.

Eligibility activities include:

- Funds to support costs that preserve the community housing

- A Building Condition Report

- Capital replacement reserve planning

- Age-friendly Conversion Assessment

- Energy Audit

*Any expenses/costs related to the eligible activities that are completed before your proposal gets approved, will not be eligible for the funding. If you are approved for the funding, the funds will be disbursed in full in the mail. To remain eligible before submitting your proposal, you must read the terms and conditions of the Preservation Funding, which is on the last page of the online application.

Register and apply through the online portal on the CMHC website. The application form is several pages long, but once completing a page, the page will save itself, if there are any spots not completed that page will not be saved. Several pages are required documents needed before the CMHC deems your proposal eligible. The maximum Preservation Funding available is up to $50,000.00 but in special cases up to $75,000.00. From the date you get approved, you’ll have 18 months to complete them. The CMHC may also require more information on your project and if you miss any deadline, the CMHC may reject your application.

8. Proposal Development Funding (PDF) for First Nation Communities

This funding opportunity is for First Nation communities to develop a proposal. A proposal is needed to apply for the Non-Profit Housing Program. Writing a proposal is one of the first steps in bringing your project to life. The funding program is available to all First Nation communities and housing organizations that want to build or buy housing through the Non-Profit Housing Program.

If you are applying for this funding opportunity, you must think about what will help make the project successful. Some of the eligible activities are:

- Best buy, viability, need and demand analysis

- Soil tests

- Drawing and specifications

- Development permits

- Site selection

- Housing acquisition exploration

- Cost estimates

If you have completed any of these activities before getting them approved, those completed activities will not be eligible for costs or reimbursement. Through this program, you may be eligible for up to $75,000.00 or depending on the size of your project you may receive additional funding.

The CMHC has other funding opportunities you may qualify for, including The Emergency Repair program, modifications, and adaptations for Seniors. If you need more information or have any questions, please contact your First Nation Housing Specialist.

9. Indigenous Shelter and Transitional Housing

The CMHC and ISC provided funding for emergency shelters for indigenous women, children and 2SLGBTQQIA+ so they can have a safe place to go while they are escaping violence. They have constructed 10 emergency shelters in First Nation communities across the country and 2 shelters in the territories. The Shelter Enhancement Program has the authority to build on First Nations lands, but they also use the National Housing Co-Investment Fund to shelter proponents on or off reserve and across the country.

The National Housing Co-Investment Fund is an ongoing program that provides capital contributions or low-cost loans for the construction, repairs, or renewals of shelters for families fleeing violence. At least 4,000 shelters across Canada will be constructed or repaired by 2028. The program offers two funding streams that help with forgivable loans of 100% for the cost of construction for new shelters. One of the streams is for on-reserve First Nation communities, the other is to build newly constructed, and the other is to build nearly constructed shelters in the funding available for shelters in territories.

Any indigenous governments or organizations that are providing housing on-reserve or in the territories are available to submit their proposals until March 1, 2024. Budgets to have a comprehensive Violence Prevention Strategy include culturally relevant support for indigenous women and children. When applying, the applicant must make sure they provide a detailed construction budget (and projects will be chosen) and an operational budget that is for their specific project. An indigenous committee is made up of a team of representatives from CMHC, ISC, organizations representing First Nations, Metis, indigenous 2SLGBTQQIA+, urban communities, subject matter experts, and people with lived experiences.

The application documents are included in PDF downloadable format:

- Highlight Sheet

- Guide

- Evaluation Criteria

- Mandatory Application Worksheet

- Application Q & A

If you have any more questions or need any more information, contact your Regional CMHC Indigenous and Northern Housing Solutions Specialist.

10. Shelter Enhancement Program

The Shelter Enhancement Program On-Reserve helps First Nations and affiliated housing organizations that help men, women, youth, and children living in shelters with the costs of operating those shelters and second-stage housing they came to because of their living situations or emergencies. These funds are for repairs, rehabilitations, or the improvement of existing shelters or second-stage housing. The assistance comes as a forgivable loan so long as your First Nation or sponsor follows the conditions and terms outlined in the agreement. Any work completed before being approved in writing will not be covered. Other eligible activities would include modifying the building for accessibility for people with disabilities, bringing the building up to code and health requirements to ensure the children have a safe environment to play and ensure everyone’s safety.

This funding program offers financial assistance for new construction of up to 100% of the project costs or a loan from a Ministerial Loan Guarantee for at least 15 years. The funding for the Renovation Stream, the maximum amount is $60,000.00 or for northern or remote areas the amount may increase by 25%. If your project needs more funds, your First Nation or sponsor will be responsible for finding those funds. If you need more information on this financial assistance program or other funding programs by the CMHC Housing Solutions Specialist to ensure you know and have everything you need before submitting your application.

11. Apartment Construction Loan Program

*First named The Rental Construction Financing Initiative (RCFi) is still accepting applications.

At the beginning of 2025/26, the newly named Apartment Construction Loan Program will have $1 billion available in loan form to build apartment rentals faster. This loan program provides eligible borrowers with low-cost loans to develop rental apartments across Canada. The maximum loan amount can be as high as $1,000,000.00 to go towards construction to finish the apartments (this does not include niche housing: retirement homes, single-room occupancy, or student housing). To be eligible for a loan, to build an apartment building, you must:

- Be part of for-profit, non-profit, or part of a municipality

- Have at least 5 beds or units in the apartment

- $1,000,000.00 in loans

- Responding to a rental supply need

- Site/zoning place with a permit with construction beginning 6 months before loan approval.

- Meet financial viability and social outcome requirements.

- Meet minimum requirements.

- financial viability

- affordability

- energy efficient

- accessibility requirements

Projects on First Nation lands now accept alternative types of security, along with MLGs (ministerial loan guarantees) by the CMHC. Before applying, contact your regional CMHC Housing Specialist to make sure you have the required documentation and minimum information need nu the CMHC, prior to submitting so that your application is reviewed, and credit approval has been completed. The required documentation is downloadable in PDF format file. Some of the information that the CMHC requires is:

- project summary

- project lands

- project specifications

- project approvals

- project budget

- land appreciation value

- pro-forma rent roll.

- pro-forma operating statement

- sources of financing

- project schedule

- and more

The CMHC prioritizes applications in this program based on the strongest applications. Applications are selected for underwriting, rejected, or kept on hold; your project may even fall under another more fitting program. It can take up to 60 days for your application to receive a conditional commitment letter.

If your application is selected, it will be sent to CMHC’s external service provider CMLS for underwriting and you’ll be required to pay application fees. After the CMLS has all the required information, it may take up to 265 days to complete the underwriting and to receive your letter of intent if your application is successful. Upon receiving your letter of intent, your loan agreement will be issued 40 days after signing the letter of intent. Do not forget to have your completed ‘Social Outcome Grid’ (Excel spreadsheet) to submit with your application. If you still have questions or require more information, please call 1-800-668-2642 or email contactcentre@cmhc.ca to speak with your CMHC Indigenous and Northern Housing Specialist.

12. Indigenous and Northern Communities:

Affordable Housing Fund: Indigenous and Northern Housing

In November 2023, the CMHC renamed the National Housing Co-Investment Fund (NHCF) to the Affordable Housing Fund and starting in 2025/26, $1 billion to build more affordable housing. Funds are still available under the NHCF until the federal government announces the changes to the Affordable Housing Fund in early 2024. This funding program provides low-cost and forgivable loans to housing providers serving indigenous peoples or housing providers that are building and renovating housing in northern communities.

This funding program prioritizes partnerships with indigenous and northern housing providers, non-profits, governments, and other organizations that prioritize affordable housing, energy efficiency, accessibility and socially inclusive. Your housing project may even qualify for several forgivable or repayable loans depending on how your project meets the housing needs. If you are applying for this program, please review:

- Product Highlight Sheet (PDF)

- New Construction – required documentation (PDF)

- Repair/Renewal - required documentation (PDF)

Your project may qualify for several loans, and speaking with your housing specialist, it can help you understand if you are eligible for more funds like SEED funding or Preservation Funding to ensure your project will receive the funds or if it’s the right stream of funding. To ensure you meet the program eligibility, contact your CMHC Indigenous and Northern Housing Specialist to assist you with what information or documentation you will need to add along with your application so that it’s considered. When applying online with the application portal, any empty slots will not be saved.

The approval and process times do take time. Preparing all required documents from the:

- New Construction – Required Documentation checklist

- Repair/Renewal – Required Documentation checklist

These documents outline the minimum documentation required at every stage you need to move forward. If your project requires specifications, you may need additional documentation. Please ensure to read and sign the:

- Integrity Declaration

- Project details and funding eligibility spreadsheet (Excel)

After speaking with your Housing Specialist to ensure you have all the information and documentation you need for your project application, it will take the CMHC up to 14 days for the preliminary review, applications are reviewed for readiness, eligibility, and completion. After you submit your application, the financial analysis, and the credit risk assessment, the assessment can take approximately 30 to 120 days from the date of application submission. Eligible applications are assessed based on:

- Financial viability

- Minimum requirements

- Socio-economic details of your project

- Local community need

- Available funding

Successful applicants will receive a Letter of Intent by the CMHC along with some conditions based on the assessment. The letter will include information such as:

- Loan amount

- Conditions to funding

- Socio-economic details of your project

- List of security required by the CMHC to secure the loan obligations

Some security documents may include:

- Mortgage security

- Ministerial loan guarantees

- Assignments of rents and leases

- Material contracts and insurance

- Inter-creditor agreement

Upon receiving your Letter of Intent, you will have 60 days to complete the conditions set in the letter. Once all required documents are together, your application will go through one more round of the approval process. The final approvement will have your loan documents ready within 40 days and after signing all the required documents, you will have 30 days to give back to the CMHC.

After meeting all eligibility requirements, signing all the required documents and fulfilling all the conditions the funding program requires you to, you will receive your funds in payments in a drawdown schedule (a specific date that money is borrowed under a loan agreement). All documents that are required by the CMHC are specified in the loan agreement.

When getting ready to apply with the online application portal, contact and speak with your regional CMHC Indigenous and Northern Housing Solution Specialist. Also, remember to pick the correct category on the program drop-down list. Work closely with your Housing Specialist to ensure you have all of the required documents and information.

By: Tricia Cook, Content Navigator